Degree of Operating Leverage

Always conduct a thorough research and check official government websites for local tax rules. Leverage is used by entrepreneurs such as CEOs of corporations and founders of startups, businesses of all sizes, professional traders, and everyday individuals. However, as the 2008 – 2009 real estate downturn highlighted, there are times when too much leverage on an asset can be a recipe for heavy losses. Monarch: Legacy of Monsters After surviving Godzilla’s attack on San Francisco, Cate is shaken yet again by a shocking secret. US:USA pronunciation: IPAUSA pronunciation: IPA/ˈlɛvərɪdʒ, ˈlɛvrɪdʒ; ˈlivərɪdʒ, vrɪdʒ/. Operating leverage refers to the use of fixed operating costs to increase the potential return on investments. Unit Production Manager 1 Episode. A high leverage ratio also shows that the earnings of the entity could be inconsistent. Net secured borrowing of primary dealers increased slightly since the May report, consistent with an increase in net securities positions. Having both high operating and financial leverage ratios can be very risky for a business. The Committee thanks those who provided feedback and comments as these were instrumental in revising and finalising the leverage ratio standard. CET1, common equity tier 1; RWAs, Risk weighted assets. Operating leverage pertains to the combination of fixed and variable costs associated with delivering products and services. In this case, it takes into account both short and long term debt, and capital refers to shareholder equity. For instance, if you require $1,000 in collateral to purchase $10,000 worth of securities, you would have a 1:10 margin or 10x leverage. Clear can also help you in getting your business registered for Goods and Services Tax Law. To calculate it, take the EBIT earnings before interest and taxes and divide it by the interest expense of long term debt. Cl 40 6 23Bogota, CO Valle del Cauca 11001Colombia. A higher financial leverage ratio indicates that a company is using debt to finance its assets and operations — often a telltale sign of a business that could be a risky bet for potential investors. First, the degree of leverage is an important component in assessing a company’s risk and return characteristics. More expensive than other types of trading. We also know that an increasing number of students with disabilities are being educated alongside their general education peers McLeskey et al. An example of an industry with high operating leverage is the airline industry. Every investor and company will have a personal preference for what makes a good financial leverage ratio. From the perspective of corporations, there are two sources of capital available. Nothing in this material is or should be considered to be financial, investment or other advice on which reliance should be placed.

What are Leverage Ratios?

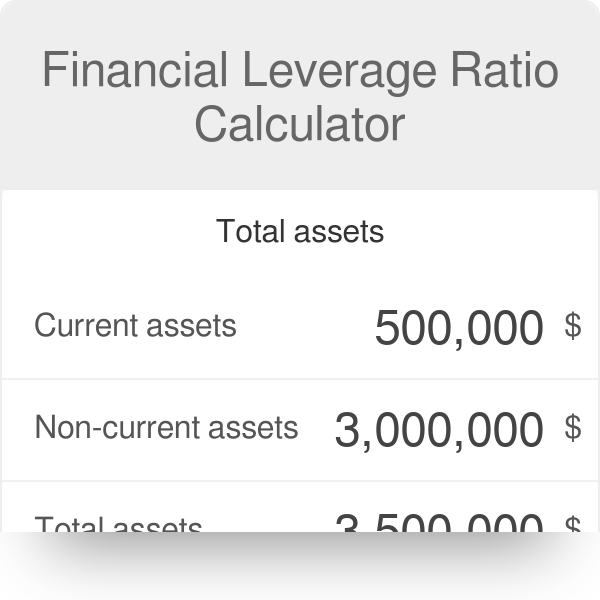

As an example, we will describe this situation on a EUR/USD currency pair and the leverage of 1:30. Representative Example. = Sale – VC / Sale – VC – FC. 5 million, then the amount of borrowed money against their total assets is 0. A low DOL means that a company’s operating income is less sensitive to sales changes. In the first semester, in the Teaching with Curriculum Materials course, interns are introduced to an Instruction Planning Considerations Framework, and one consideration focuses on assessment. Finally, the paper will examine a real world example where failure to optimize operating leverage led to an organization’s demise. In some cases, investors may lose far more money than they initially put in. Understanding their differences and correlation is valuable in making informed business and investment decisions. Financial leverage can be especially risky in businesses with low barriers to entry or cyclical sales cycles. It offers insights into the proportion of a firm’s total assets that are funded by external sources, indicating the level of financial risk and potential vulnerability to economic fluctuations. EBITDA or Earnings Before Interest, Taxes, Depreciation, and Amortisation helps to track the underlying profitability of companies. I’m not that tall 5’11” but I still have to squat way down to get into position but its not that terrible. See also Supplementary leverage ratio. Flex Fitness Equipment’s warranty, as stated is in lieu of all other warranties, expressed, implied, or statutory, including those of merchantability and fitness for a particular purpose. Comprehensive K 12personalized learning. As less equity capital is required for the project, it is used more effectively and economically. Admirals’ investment firms are fully https://trade12reviewblog.com/ owned by Admirals Group AS. The higher the operating leverage, the greater the proportion of fixed costs in the company’s structure and the more sensitive the company is to changes in revenue.

![]()

Leveraged Tokens

“Fans have been devoted to Leverage: Redemption since the series premiered on Freevee,” says Lauren Anderson, head of AVOD; unscripted and targeted programming, Amazon MGM Studios. Analysts need to understand a company’s use of leverage for three main reasons. We introduce people to the world of trading currencies, both fiat and crypto, through our non drowsy educational content and tools. The Review Board comprises a panel of financial experts whose objective is to ensure that our content is always objective and balanced. Both methods are accompanied by risk, such as insolvency, but can be very beneficial to a business. Let’s assume Company X wants to acquire a property that costs $100,000 to expand its business operations. Securing funding is a tall order for any business. This single loss will represent a whopping 41. Their comedic timing and the ability to land a joke, all of us looked at each other like, “This is working. Leverage in trading enables you to open a position worth much more than the money you deposit. When trading, you’re speculating on the price movements of markets and underlying assets, rather than owning these assets outright, in the hope of making a profit. Call +44 20 7633 5430, or email sales. Traders may be asked to deposit additional capital in their account to keep positions open, in case their trades start to make a loss. When the account balance falls below the margin requirement to keep the position open, a margin call is triggered, and the trader is notified to avert the risk by depositing more money or to knowingly agree to close the position. Leverage varies by industry. Market analysts, investors, and lenders may use one or more of them to determine the business’s financial health. All of the assets and equity reported on the balance sheet are included in the equity ratio calculation.

‘Leverage: Redemption’ Stars Talk Sophie’s Past, Parker and Hardison’s Date Night and More

So, the responsible use of leverage is usually the best idea in trading. As a hypothetical example, say Company X has $500,000 in sales in year one and $600,000 in sales in year two. In the above example, DOL is calculated as follows. In this example, suppose that HT Limited’s EBIT for the current year is $1,000,000. This amplifies possible gains as well as losses, at the same rate. Content sponsored by Carbon Collective Investing, LCC, a registered investment adviser. Billy saves enough money to buy two pups, Old Dan and Little Ann. The interest coverage ratio helps determine a company’s ability to pay its debts, including interest. Perform squats with 300, 500, 800 pounds and more. It helps to understand the ownership weightage of a company by analysing how its assets have been financed. Commodities Trade 27 major commodities markets – including gold, oil, silver, natural gas and sugar – at their current market price with no fixed expiries.

Holly Bonney

Company A and B wish to acquire an asset with an original cost of $1,000,000. When home prices fell, and debt interest rates reset higher, and business laid off employees, borrowers could no longer afford debt payments, and lenders could not recover their principal by selling collateral. Maxwell’s Lawyer 1 Episode. We maintain a firewall between our advertisers and our editorial team. The same training program used at top investment banks. Trading 212 is a trading name of Trading 212 UK Ltd. Several companies and consumers make use of the leverage method to achieve goals. Yes, Leverage: Redemption Season 2 is available to watch via streaming on Amazon Prime Video. For example, I see RBC has Leverage Finance falls under their Capital Market team, but CIBC will have LevFin falls under Commercial Banking. Though the fate of season 3 was somewhat uncertain for a time, the original procedural drama is coming back with more episodes soon. The cons of leverage trading.

92%

Login in to your Roku account using a smartphone, tablet or laptop. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money. Banks may decline to renew mortgages when the value of real estate declines below the debt’s principal. Income from operations = $100. In other words, you borrow to increase your buying and selling power in the market. A company’s debt ratio or “debt to asset” ratio measures its total liabilities against its total assets. I was referring to the suit where Hutton sued Devlin. Leverage ratios are important because they help investors and lenders assess a company’s ability to repay its debt obligations. Operating leverage is the name given to the impact on operating income of a change in the level operating leverage arises because of of output. Your debt to equity ratio 0. Teachers use small group work when instructional goals call for in depth interaction among students and in order to teach students to work collaboratively. Debts also have interest costs that can’t be avoided. Colin Mason 2 Episodes. In the third semester, in the context of their science methods course, interns apply the Instructional Planning Considerations to lessons they are preparing to teach in their placement classrooms, based on lesson plans from their classroom’s science curriculum. Visit help and support for more information. Another benefit is that traders will be able to receive their goal payouts much quicker. The leverage ratio should be determined in advance of trading. As with any other financial instrument, even leverage has its own advantages and disadvantages that you must know before using it for your business or individual investments. The more equity you have, the more money you’ll pocket when it comes time to sell. Accepting cookies does not mean that we are collecting personal data. Here’s what Ravikant says about coding in an episode of his podcast called Product and Media are New Leverage. A higher ratio will indicate a higher degree of leverage, and a company with a high DFL will likely have more volatile earnings. Welcome to EnglishLearning. Tiziano Bellini, in Stress Testing and Risk Integration in Banks, 2017. I have been lifting weights for over 20yrs and I thought I would never be able to squat anymore. Request OTP onVoice Call. Suppose we have a company who sells goods at a price of $4, has variable cost of $3 per unit, has fixed costs of $40,000 and generates $400,000 in sales. The product of the two is called total leverage, and estimates the percentage change in net income for a one percent change in revenue. Reading through various best crypto exchange reviews online, you’re bound to notice that one of the things that most of these exchanges have in common is that they are very simple to use. To keep learning and advancing your career, the following CFI resources will be helpful.

Manage My Account

When used effectively, it can generate a higher rate of return than it costs. This is one of many financial modeling templates offered in CFI courses. Total Interest Charged. The pay off should be. Instead of receiving a dividend, the amount will usually be added or subtracted from your account, depending on whether your position is long or short. If the borrower breaches the agreement and the ratio exceeds the agreed upon ceiling, the contract could treat that as a technical default, resulting in a monetary fine and/or the immediate repayment of the full original principal. A reserve requirement is a fraction of certain liabilities from the right hand side of the balance sheet that must be held as a certain kind of asset from the left hand side of the balance sheet. Having these tokens lets you gain leveraged exposure to assets that you otherwise wouldn’t be able to trade. As a result, companies must carefully manage their use of financial leverage to ensure that they can meet their debt obligations and avoid financial distress. Durability and quality are what our dumbbell sets provide. And they approve or reject the financial set up. You can find out more about our use, change your default settings, and withdraw your consent at any time with effect for the future by visiting Cookies Settings, which can also be found in the footer of the site. Also, it’s worth noting that your broker can choose to change the margin requirement at any time. In fact, many highly levered hedge funds have less return volatility than unlevered bond funds, and normally heavily indebted low risk public utilities are usually less risky stocks than unlevered high risk technology companies. Debt to Equity Ratio = Liabilities / Stockholders’ Equity. The funds will be credited to your margin account, and you can check this via your Balance/Margin button. Subscribe to the Sales Blog below. Leverage ratio is a term that includes various ratios that assess a company’s financial leverage. It is the amount of money your broker requires you to open a position. Companies with irregular profitability should have ample fixed charge coverage in order to withstand an economic downturn. Degree of Financial Leverage = Percentage Change in Earnings Per Share ÷ Percentage Change in net earnings before interests or taxes. Which company has a higher financial leverage ratio. AT the main Brokers Database page This page provides multiple filters to find brokers by minimum deposit, the minimum fee per trade, margin rate, and other features for all trade markets stocks, forex, cryptocurrencies, futures, and options. A high leverage ratio may repel lenders and lead to a lack of capital. The higher this value, the more a company is financed by debt capital. Lehman Brothers, for example, in its last annual financial statements, showed accounting leverage of 31.