Standard Requirements getting Care about-Working Loans

- Credit rating. Conventional finance have more strict credit rating conditions than authorities-backed financing (ex: FHA money), and personal financing aren’t credit rating passionate.

- Credit history. Much like the a couple of-12 months rule regarding your money, you will additionally must show at the least 2 years out of borrowing from the bank history which have toward-date money. Private finance not one of them a particular length of borrowing from the bank; not, delinquencies (ex: foreclosure) will demand next reason.

- Newest expenses and you will debt-to-earnings proportion (DTI). Zero earnings files will become necessary to possess https://clickcashadvance.com/personal-loans-tx/magnolia/ personal fund owing to Vaster just like the we do not need certainly to make sure they in this instance. You’ll need to render two years’ value to possess confirmation for everybody other mortgage versions, plus DTI cannot meet or exceed fifty percent.

- Liquids discounts and possessions. You will have to promote a copy of bank statements getting private funds. Your bank account need reveal that you really have sufficient exchangeability so you’re able to coverage half a dozen months’ property value notice repayments. Exchangeability ‘s the sum of money and you can assets available so you’re able to make ends meet to the quick see.

Extremely mortgage lenders will need you to see particular or all the of the above criteria to help you be eligible for home financing. Try to keep very intricate information because a home-operating people; you will need to create various sorts of documentation into the property process.

Self-Working Earnings Papers

There are many ways you can show money since the a personal-functioning individual. Should you contract functions, your employer might present good 1099 mode within the end of the brand new tax season. Here are some other ways to show your revenue.

- Individual lender comments

- A return/losses report

- a couple of years value of tax returns (including your organization tax returns)

- Spend stubs (for people who shell out your self by doing this)

Before you complete your own home loan application, be certain that easy access to any very important records; the financial institution usually ask for him or her instantly.

Will you be Mind-Functioning?

Not sure for folks who be considered once the a personal-working people? Youre considered mind-working for individuals who own 25 percent (minimum) out of a business, are good freelancer, or become a different contractor and you may located a great 1099 tax setting.

Samples of Mind-A career

- Business owner

These types of sphere regarding performs (and many others) is searched for from the freelancers because they’re in popular and then have higher-earnings prospective.

Self-Operating Money Calculation

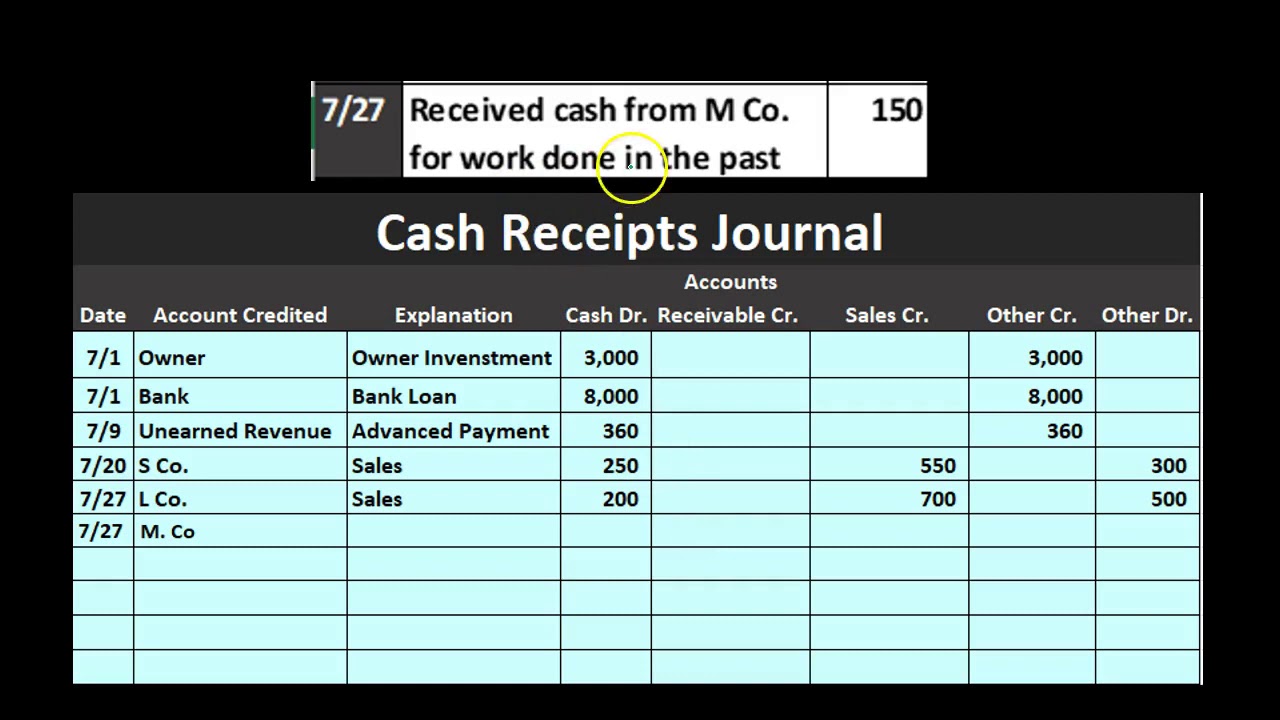

Of earnings, home loan businesses will often have more problem crunching the newest wide variety having freelancers otherwise separate designers. So you’re able to calculate the fresh new payment getting care about-operating some body, lenders need to refer to data files such as for example 1099’s or funds/losses statements. Talking about quicker quick than simply a typical pay stub or W-2.

If you find yourself self-employed, loan providers check your net gain, perhaps not their revenues, particularly they might should you have a great W-2 standing. If you wish to estimate the net income for the home loan software, pursue these simple actions.

Understanding your own net income offers particular concept of just what to anticipate regarding a mortgage company; not, the financial institution commonly still need to make certain your revenue on their own.

Get a home-Working Financial Having Vaster

There’s no much time and removed-aside buy processes. All of our competent loan professionals assist family seekers close to your characteristics rapidly; how it shall be.

Regardless if you are a freelancer or an entrepreneur, we possess the most readily useful home loan provider for each and every sorts of consumer. Get in touch with all of us; we are going to enable you to get into your fantasy domestic.

In order to be eligible for financing due to the fact a personal-functioning individual, you’ll have to meet certain conditions very first. Since the highlighted significantly more than, all of the loan method of has its own conditions, however, this is basically the full list very loan providers look for out-of a beneficial debtor.