If you were to draft a list of subjects extremely Us americans are embarrassing these are, financial obligation and you can dying will likely arrive on the top of number. Yet one another victims is things away from lifestyle therefore every you desire to understand what types of debt try online and you will just what our very own financial obligation and you may responsibilities was when a relative dies.

According to economic guru and you can chat inform you host, Dave Ramsey, the average American possess in the $31,800 in financial trouble not relying a home loan. Even though you might think that all debt dilemmas have a tendency to die along with you, you’ll be able to the ones you love you’ll inherit your debt. Discuss partial team!

The rules out-of Financial obligation Immediately following Passing

The initial idea regarding debt once dying is the fact people loans that is about age just will get paid of the the property. (A home is the fresh possessions that are available at the time away from demise-residential property, cars, bank accounts, brings and you can bonds, and so on.) The individual tabbed to repay a property, the new executor, will be guilty of managing the fresh product sales of property possessions and you will settling any loan providers. Exactly what in the event your costs are greater than the fresh new liquidated really worth of your own house (into the court conditions the newest house was insolvent)? Then your payment of the home could possibly get harder.

Getting insolvent properties there is certainly a great pecking acquisition to have exactly who will get paid back and exactly how they receive money dependent on and this from a couple of types of debt incorporate. Having secured financial obligation like a mortgage loan or auto loan, your debt was supported (secured) by the an asset (property otherwise an automobile, such as for instance) which is sold and continues visit the lender. Unsecured debt such credit cards, scientific bills, otherwise personal loans will likely go unpaid when there is no cash on property.

Heirs ought not to dispersed assets from a property up to all the debts were settled. If the property try paid and therefore the property does not enough money to pay for the expenses, the individuals heirs would-be to the link towards unpaid personal debt. So you shouldn’t be as well short provide away grandma’s precious jewelry or grandpa’s vessel.

8 of the most extremely Prominent Style of Debt

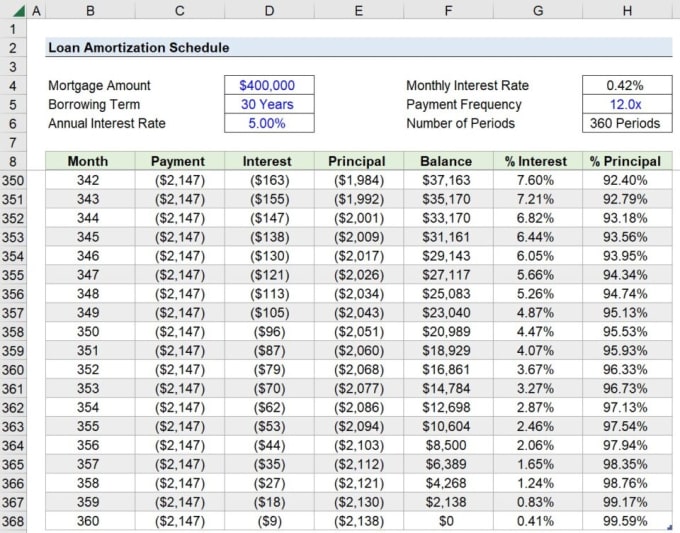

Home mortgages: Domestic co-residents otherwise inheritors are responsible for the remaining mortgage, Ramsey records. However they are just required to maintain the fresh monthly payments and do not have to pay straight back an entire financial most of the at a time. They can and love to sell the house to keep they away from starting foreclosures.

House Guarantee Funds: If someone else inherits a property which is encumbered which have a house equity loan, the financial institution is demand immediate percentage. In the event your heirs are unable otherwise unwilling to pay off new loan otherwise consistently make monthly premiums, then family may need to be install obtainable to repay the duty.

Car and truck loans: As previously mentioned a lot more than, a car loan is within the secure loans class, this is the automobile is equity. In the event the holder dies one of about three something should come-this new heirs normally always improve loan costs, the car will likely be sold to the continues regularly shell out off the financing, or the financial can get repossess the vehicle.

Scientific Financial obligation: Unsecured scientific personal debt is easily the brand new thorniest form of obligations so you can handle. In most says medical personal debt have important reputation to have payment when a home was paid. In the event the inactive obtained Medicaid gurus any moment once they turned into 55, the official could possibly get pursue repayment on the estate. Since the medical financial obligation can be so cutting-edge, it’s always best to check with a legal professional.

Credit debt: Having credit card debt, combined customers are usually completely accountable for all of that are due on the charge card account regardless of if all the costs were made because of the one of those. If there is no mutual membership proprietor and the estate are insolvent, the credit card issuer tend to generally speaking just dismiss your debt. It is value listing that in case you’re merely an enthusiastic authorized associate of cards, they’re not obligated into the credit card debt.

Student education loans: Government figuratively speaking is deleted in the event the borrower dies. But not, private student education loans are not cleaned brush. The latest delinquent dominating and you may attention on the a private student loan enjoys to-be included in new deceased’s house. But including personal credit card debt if you have insufficient from the home to pay for student education loans, they usually wade unpaid.

Overall Worry Will set you back: Certain claims has enacted filial obligation legislation, definition pupils is going to be compelled to spend its dead parents’ a lot of time-name care and attention costs for expenses such as healthcare facilities and you can nursing homes. Even though neither Nebraska nor Iowa has filial obligations laws and regulations, for those who have parents way of life in other places you prefer discover what what the law states is the perfect place they live. Fortunately you to definitely filial obligations statutes aren’t commonly enforced; nevertheless don’t want to exposure becoming caught off guard.

Timeshares” Really timeshare agreements include an effective perpetuity condition covering restoration fees. As a result the duty to pay the latest timeshare repair fees is bequeath to people which inherit a timeshare. Heirs is, without a doubt, will not afford the charge, it might not avoid a timeshare business out-of bombarding her or him having payment.

For legal reasons, creditors must be informed whenever a debtor tickets on. Either new executor of your own property otherwise a member of family need to undertake this. After that creditors has particular big date limitations so you can document their says. Within the Nebraska, in case the executor provides notified loan providers by publishing a notice away from Passing, a creditor only has 2 months in the date of the very first notice publication to help you file a claim.

In the event that a creditor need to have acquired an individual notice but performed not, they can apply to the fresh court to have an expansion if they exercise within 60 days of your notice deadline. In the event the zero Notice out-of Dying try typed, creditors features three years in the decedent’s passing so you’re able to document good allege against the home. For the Iowa creditors possess six months after a demise to submit a state facing one individuals home.

The conclusion

Creditors is also file to get off a house, but until a deceased man or woman’s members of the family are co-signers otherwise have been in other means legitimately in control, its unlawful to own financial institutions to try to fit family members for cash.

This information provides standard pointers just https://cashadvanceamerica.net/loans/payday-loans-with-no-checking-account/. This is simply not an alternative choice to a qualified court thoughts. We advice asking an attorney towards information on your role.